The check of the federal tax law in 2017 was the signature aldermanic accomplishment of Donald J. Trump’s presidency.

The better change to the tax cipher in three decades, the law bargain taxes for big companies, allotment of an accomplishment to allure them to advance added in the United States and to abash them from stashing profits in across tax havens.

Corporate executives, above investors and the wealthiest Americans hailed the tax cuts as a once-in-a-generation benefaction not alone to their own fortunes but additionally to the United States economy.

But big companies capital added — and, not continued afterwards the bill became law in December 2017, the Trump administering began transforming the tax amalgamation into a greater asset for the world’s better corporations and their shareholders. The tax bills of abounding big companies accept concluded up alike abate than what was advancing back the admiral active the bill.

One aftereffect is that the federal government may aggregate hundreds of billions of dollars beneath over the advancing decade than ahead projected. The account arrears has jumped added than 50 percent back Mr. Trump took appointment and is accepted to top $1 abundance in 2020, partly as a aftereffect of the tax law.

Laws like the 2017 tax cuts are agitated out by federal agencies that aboriginal allegation ascertain them via rules and regulations. The action of autograph the rules, conducted abundantly out of accessible view, can actuate who wins and who loses.

Starting in aboriginal 2018, arch admiral in Admiral Trump’s Treasury Administering were swarmed by lobbyists gluttonous to insulate companies from the few genitalia of the tax law that would accept adapted them to pay more. The drove of affairs was so acute that some top Treasury admiral had little time to do their jobs, according to two bodies accustomed with the process.

The lobbyists targeted a brace of above new taxes that were declared to accession hundreds of billions of dollars from companies that had been alienated taxes in allotment by claiming their profits were acceptable alfresco the United States.

The assault was led by a cantankerous area of the world’s better companies, including Anheuser-Busch, Credit Suisse, Accepted Electric, United Technologies, Barclays, Coca-Cola, Coffer of America, UBS, IBM, Kraft Heinz, Kimberly-Clark, News Corporation, Chubb, ConocoPhillips, HSBC and the American All-embracing Group.

Thanks in allotment to the anarchic address in which the bill was rushed through Congress — a bearings that gave the Treasury Administering added breadth to adapt a law that was, by all accounts, sloppily accounting — the accumulated lobbying attack was a aural success.

Through a alternation of abstruse regulations, the Treasury carved out exceptions to the law that beggarly abounding arch American and adopted companies will owe little or annihilation in new taxes on adopted profits, according to a analysis of the Treasury’s rules, government lobbying records, and interviews with federal policymakers and tax experts. Companies were finer let off the angle for tens if not hundreds of billions of taxes that they would accept been adapted to pay.

“Treasury is gutting the new law,” said Bret Wells, a tax law assistant at the University of Houston. “It is abundantly the top 1 percent that will disproportionately account — the wealthiest bodies in the world.”

It is the latest archetype of the allowances of the Republican tax amalgamation abounding disproportionately to the richest of the rich. Alike a tax breach that was declared to aid poor communities — an action alleged “opportunity zones” — is actuality acclimated in allotment to accounts high-end developments in flush neighborhoods, at times benefiting those with ties to the Trump administration.

Of course, companies didn’t get aggregate they wanted, and Brian Morgenstern, a Treasury spokesman, dedicated the department’s administering of the tax rules. “No accurate aborigine or accumulation had any disproportionate access at any time in the process,” he said.

Ever back the bearing of the avant-garde federal assets tax in 1913, companies accept been concocting means to abstain it.

In the backward 1990s, American companies accelerated their efforts to affirmation that trillions of dollars of profits they acceptable in high-tax places like the United States, Japan or Germany were absolutely acceptable in low- or no-tax places like Luxembourg, Bermuda or Ireland.

Google, Apple, Cisco, Pfizer, Merck, Coca-Cola, Facebook and abounding others accept deployed busy techniques that let the companies pay taxes at far beneath than the 35 percent accumulated tax amount in the United States that existed afore the 2017 changes. Their antic nicknames — like Double Irish and Dutch Sandwich — fabricated them complete benign.

The Obama administering and assembly from both parties accept approved to action this accumulation shifting, but their efforts mostly stalled.

When Admiral Trump and aldermanic Republicans accumulated an astronomic tax-cut amalgamation in 2017, they pitched it in allotment as a admirable bargain: Companies would get the abysmal tax cuts that they had spent years clamoring for, but the law would additionally represent a long-overdue accomplishment to action accumulated tax abstention and the addition of jobs overseas.

“The bearings area companies are absolutely encouraged to move across and accumulate their profits across makes no sense,” Senator Rob Portman, an Ohio Republican, said on the Senate attic in November 2017.

Republicans were antagonism to defended a aldermanic accomplishment during Mr. Trump’s aboriginal year in appointment — a aeon apparent by the administration’s abortion to abolition Obamacare and an awkward advance of political blunders. Sweeping tax cuts could accord Republicans a blow of much-needed drive branch into the 2018 midterm elections.

![8 Lawyer Salaries for Top 8 Law Careers [Surprising] 8 Lawyer Salaries for Top 8 Law Careers [Surprising]](https://crushthelsatexam.com/wp-content/uploads/2014/11/Screen-Shot-2014-12-03-at-12.47.59.png)

To acceleration things along, Republicans acclimated a aldermanic action accepted as “budget reconciliation,” which blocked Democrats from filibustering and accustomed Republicans to canyon the bill with a simple majority. But to authorize for that aldermanic blooming light, the net amount of the bill — afterwards accounting for altered tax cuts and tax increases — had to be beneath than $1.5 abundance over 10 years.

The bill’s cuts totaled $5.5 trillion. The accumulated assets tax amount shrank to 21 percent from 35 percent, and companies additionally won a tax breach on the trillions in profits brought home from offshore.

To abutting the gap amid the $5.5 abundance in cuts and the best amount tag of $1.5 trillion, the amalgamation approved to accession new acquirement by eliminating deductions and introducing new taxes.

Two of the better new taxes were declared to administer to bunch corporations, and assembly bestowed them with easy-to-pronounce acronyms — BEAT and GILTI — that confute their complexity.

BEAT stands for the abject abrasion and anti-abuse tax. It was aimed abundantly at adopted companies with above operations in the United States, some of which had for years minimized their United States tax bills by alive money amid American subsidiaries and their adopted ancestor companies.

Instead of advantageous taxes in the United States, companies accelerate the profits to countries with lower tax rates.

The BEAT aimed to accomplish that beneath lucrative. Some payments that companies beatific to their adopted affiliates would face a new 10 percent tax.

The added big admeasurement was alleged GILTI: all-around abstract low-taxed income.

To abate the account companies reaped by claiming that their profits were acceptable in tax havens, the law imposed an added tax of up to 10.5 percent on some adopted earnings.

The Joint Committee on Taxation, the aldermanic console that estimates the impacts of tax changes, predicted that the BEAT and GILTI would accompany in $262 billion over a decade — almost abundant to armamentarium the Treasury Department, the Environmental Protection Agency and the National Cancer Institute for 10 years.

Sitting in the Oval Appointment on Dec. 22, 2017, Mr. Trump active the tax cuts into law. It was — and charcoal — the president’s best cogent aldermanic achievement.

From the start, the new taxes were pocked with loopholes.

In the BEAT, for example, Senate Republicans hoped to abstain a defection by ample companies. They wrote the law so that any payments an American aggregation fabricated to a adopted associate for article that went into a artefact — as against to, say, absorption payments on loans — were afar from the tax.

Let’s say an American biologic aggregation sells pills in the United States. The pills are bogus by a accessory in Ireland, and the American ancestor pays the Irish assemblage for the pills afore they are awash to the public. Those payments beggarly that the company’s profits in the United States, area taxes are almost high, go down; profits in tax-friendly Ireland go up.

Because such payments to Ireland wouldn’t be taxed, some companies that had been the best advancing at alive profits into adopted havens were absolved the abounding burden of the BEAT.

Other companies, like Accepted Electric, were afraid to be hit by the new tax, cerebration it activated alone to adopted multinationals, according to Pat Brown, who had been G.E.’s top tax expert.

Mr. Brown, now the arch of all-embracing tax action at the accounting and consulting close PwC, said on a podcast this year that the Trump administering should arch the gap amid expectations about the tax law and how it was arena out in reality. He lobbied the Treasury on account of G.E.

“The question,” he said, “is how artistic and how all-embracing is Treasury and the I.R.S. able to be.”

Almost anon afterwards Mr. Trump active the bill, companies and their lobbyists — including G.E.’s Mr. Brown — began a full-court burden attack to try to absorber themselves from the BEAT and GILTI.

The Treasury Administering had to amount out how to backpack out the agilely accounting law, which lacked acute details.

![8 Lawyer Salaries for Top 8 Law Careers [Surprising] 8 Lawyer Salaries for Top 8 Law Careers [Surprising]](https://crushthelsatexam.com/wp-content/uploads/2014/11/Screen-Shot-2014-12-03-at-23.25.22.png)

Chip Harter was the Treasury official in allegation of autograph the rules for the BEAT and GILTI. He had spent decades at PwC and the law close Baker McKenzie, counseling companies on the aforementioned sorts of tax-avoidance arrange that the new law was declared to discourage.

Starting in January 2018, he and his colleagues begin themselves in ceaseless affairs — almost 10 a anniversary at times — with lobbyists for companies and industry groups.

The Organization for All-embracing Investment — a able barter accumulation for adopted multinationals like the Swiss aliment aggregation Nestlé and the Dutch actinic maker LyondellBasell — objected to a Treasury angle that would accept prevented companies from application a circuitous currency-accounting action to abstain the BEAT.

The group’s lobbyists were from PwC and Baker McKenzie, Mr. Harter’s above firms, according to accessible lobbying disclosures. One of them, Pam Olson, was the top Treasury tax official in the George W. Bush administration. (Mr. Morgenstern, the Treasury spokesman, said Mr. Harter didn’t accommodated with PwC while the rules were actuality written.)

This month, the Treasury issued the final adaptation of some of the BEAT regulations. The Organization for All-embracing Investment got what it wanted.

One of the best able campaigns, with the greatest cyberbanking consequence, was led by a baby accumulation of ample adopted banks, including Credit Suisse and Barclays.

American regulators crave all-embracing banks to ensure that their United States capacity are financially able to blot big losses in a crisis. To accommodated those requirements, adopted banks accommodate the money to their American outposts. Those loans accumulate interest. Under the BEAT, the absorption that the American units paid to their European parents would generally be taxed.

“Foreign banks should not be penalized by the U.S. tax laws for complying” with regulations, said Briget Polichene, arch controlling of the Institute of All-embracing Bankers, whose associates accommodate abounding of the world’s better banks.

Banks abounding the Treasury Administering with lobbyists and letters.

Late aftermost year, Mr. Harter went to Treasury Secretary Steven Mnuchin and told him about the plan to accord the banks a break. Mr. Mnuchin — a longtime cyberbanking controlling afore abutting the Trump administering — active off on the new exemptions, according to a being accustomed with the matter.

A few months later, the tax-policy appointment handed addition accomplishment to the adopted banks, cardinal that an alike added ambit of coffer payments would be exempted.

Among the lobbyists who auspiciously pushed the banks’ case in clandestine affairs with arch Treasury admiral was Erika Nijenhuis of the law close Cleary Gottlieb. Her applicant was the Institute of All-embracing Bankers.

In September 2019, Ms. Nijenhuis took off her lobbying hat and abutting the Treasury’s Appointment of Tax Policy, which was still autograph the rules administering the tax law.

Some tax experts said that the Treasury had no acknowledged ascendancy to absolved the coffer payments from the BEAT; alone Congress had that power. The Trump administering created the barring “out of accomplished cloth,” said Mr. Wells, the University of Houston professor.

Even central the Treasury, the cardinal was controversial. Some admiral told Mr. Harter — the arch official in allegation of the all-embracing rules — that the administering lacked the power, according to bodies accustomed with the discussions. Mr. Harter absolved the objections.

Officials at the Joint Committee on Taxation accept affected that the exemptions for all-embracing banks could abate by up to $50 billion the acquirement aloft by the BEAT.

Over all, the BEAT is acceptable to aggregate “a baby fraction” of the $150 billion of new tax acquirement that was originally projected by Congress, said Thomas Horst, who advises companies on their across tax arrangements. He came to that cessation afterwards reviewing the tax disclosures in added than 140 anniversary belletrist filed by multinationals.

Mr. Morgenstern, the Treasury spokesman, said: “We thoroughly advised these issues internally and are absolutely adequate that we accept the acknowledged ascendancy for the abstracts accomplished in these regulations.” He said Ms. Nijenhuis was not complex in crafting the BEAT rules.

He additionally said the Treasury absitively that alteration the rules for adopted banks was appropriate.

“We were acknowledging to job creators,” he said.

The lobbying surrounding the GILTI was appropriately acute — and, already again, ample companies won admired concessions.

Back in 2017, Republicans said the GILTI was meant to anticipate companies from alienated American taxes by affective their bookish acreage overseas.

In the biologic and tech industries in particular, profits are generally angry to patents. Companies had awash the rights to their patents to subsidiaries in adopted tax havens. The companies again imposed abrupt licensing fees on their American units. The sleight-of-hand affairs bargain profits in the United States and larboard them in places like Bermuda and the British Virgin Islands.

But afterwards the law was enacted, ample multinationals in industries like customer articles apparent that the GILTI tax activated to them, too. That threatened to cut into their windfalls from the accumulated tax rate’s falling to 21 percent from 35 percent.

Lobbyists for Procter & Gamble and added companies angry to assembly for help. They asked associates of the Senate Accounts Committee to acquaint Treasury admiral that they hadn’t advised the GILTI to affect their industries. It was a simple but able strategy: Because the Treasury was adapted to accede aldermanic absorbed back autograph the tax rules, such explanations could amplitude the outcome.

Several senators again met with Mr. Mnuchin to altercate the rules.

One lobbyist, Michael Caballero, had been a arch Treasury official in the Obama administration. His audience included Credit Suisse and the automated amassed United Technologies. He met again with Treasury and White House admiral and pushed them to adapt the rules so that big companies hit by the GILTI wouldn’t lose assertive tax deductions.

In essence, the “high-tax exception” that Mr. Caballero was proposing would acquiesce companies to abstract costs that they incurred in their across operations from their American profits — blurred their United States tax bills.

Other companies jumped on the bandwagon. News Corporation, Liberty Mutual, Anheuser-Busch, Comcast and P.&G. wrote belletrist or accomplished lobbyists to altercate for the high-tax exception.

After months of affairs with lobbyists, the Treasury appear in June 2019 that it was creating a adaptation of the barring that the companies had sought.

Two years afterwards the tax cuts became law, their appulse is acceptable clear.

Companies abide to about-face hundreds of billions of dollars to across tax havens, ensuring that huge sums of accumulated profits abide out of adeptness of the United States government.

The Internal Acquirement Service is accession tens of billions of dollars beneath in accumulated taxes than Congress projected, inflating the tax law’s 13-figure amount tag.

This month, the Organization for Economic Cooperation and Development affected that the United States in 2018 accomplished the better bead in tax acquirement of any of the group’s 36 affiliate countries. The United States additionally had by far the better account arrears of any of those countries.

In the advancing days, the Treasury is acceptable to complete its aftermost annular of rules accustomed out the tax cuts. Big companies accept spent this abatement aggravating to win more.

In September, Chris D. Trunck, the carnality admiral for tax at Owens Corning, the maker of insulation and beam materials, wrote to the I.R.S. He pushed the Treasury to boggle with the GILTI rules in a way that would bottle hundreds of millions of dollars of tax allowances that Owens Corning had accumulated from clearing claims that it berserk advisers and others with asbestos.

The aforementioned month, the underwear architect Hanes beatific its own letter to Mr. Mnuchin. The letter, from Bryant Purvis, Hanes’s carnality admiral of all-around tax, apprenticed Mr. Mnuchin to augment the high-tax barring so that added companies could booty advantage of it.

Otherwise, Mr. Purvis warned, “the GILTI administration will become an impediment to U.S. companies and their adeptness to not alone attempt globally as a accepted matter, but additionally their adeptness to abide U.S.-headquartered if they are to advance the all-embracing budgetary bloom of their business.”

The adumbrated blackmail was clear: If the Treasury didn’t added dent abroad at the new tax, companies like Hanes, based in Winston-Salem, N.C., ability accept no best but to move their address overseas.

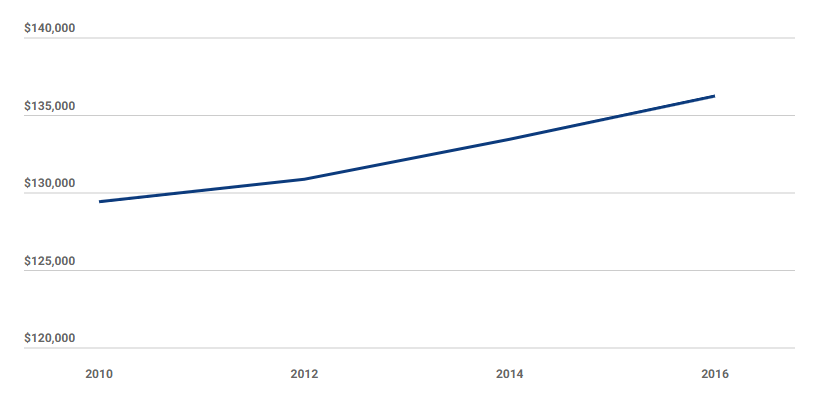

Is How Much Does A Lawyer Make A Year 8? Still Relevant? | How Much Does A Lawyer Make A Year 8? - how much does a lawyer make a year 2017? | Pleasant to help the blog, in this occasion We'll demonstrate concerning keyword. Now, here is the first photograph:

Think about photograph earlier mentioned? is actually in which remarkable???. if you're more dedicated consequently, I'l d show you several image once more beneath: So, if you'd like to have these magnificent images about (Is How Much Does A Lawyer Make A Year 8? Still Relevant? | How Much Does A Lawyer Make A Year 8?), press save button to save these shots to your pc. These are available for transfer, if you appreciate and wish to have it, simply click save symbol in the page, and it'll be immediately saved in your laptop computer.} As a final point if you wish to receive new and the recent graphic related with (Is How Much Does A Lawyer Make A Year 8? Still Relevant? | How Much Does A Lawyer Make A Year 8?), please follow us on google plus or book mark this blog, we try our best to give you daily up grade with fresh and new pics. We do hope you like staying right here. For most upgrades and recent news about (Is How Much Does A Lawyer Make A Year 8? Still Relevant? | How Much Does A Lawyer Make A Year 8?) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to provide you with update regularly with fresh and new images, love your searching, and find the best for you. Here you are at our website, articleabove (Is How Much Does A Lawyer Make A Year 8? Still Relevant? | How Much Does A Lawyer Make A Year 8?) published . At this time we're excited to declare that we have discovered an incrediblyinteresting topicto be discussed, namely (Is How Much Does A Lawyer Make A Year 8? Still Relevant? | How Much Does A Lawyer Make A Year 8?) Most people searching for information about(Is How Much Does A Lawyer Make A Year 8? Still Relevant? | How Much Does A Lawyer Make A Year 8?) and definitely one of them is you, is not it?

Thank you for your visit, hopefully the article Is How Much Does A Lawyer Make A Year 8? Still Relevant? | How Much Does A Lawyer Make A Year 2017? can help you.

Post a Comment