Brace yourself, employers. The new overtime aphorism is advancing for you in 2020.

As an employer, you apperceive all too able-bodied how ambagious overtime rules can be. And starting in 2020, they’re activity to get aloof a little bit added complicated.

If you’re not abiding about all this overtime commotion, here’s the scoop. In January 2020, the DOL new overtime aphorism will be agitation abounding employers’ worlds. According to the Department of Labor, this new aphorism will accomplish almost 1.3 actor workers anew acceptable for overtime pay.

So giddy-up for the new changes, my adolescent employers. Read on to ascertain how the new overtime aphorism will appulse your business and what changes your aggregation ability accept to accomplish to accede with the new rule.

Starting January 1, 2020, the FLSA bacon beginning will be accretion to $35,568 annually, or $684 weekly.

To put things into perspective, the bacon beginning for absolution was $23,660 per year, or $455 per anniversary afore the overtime aphorism update.

So, you ability be asking, What does this beggarly for my business, Mike? OK, OK, I’ll get to the point already. The new beginning agency big changes for some of your employees. The beginning change could accomplish abounding advanced absolved advisers anew nonexempt.

You acceptable apperceive by now that absolved advisers are not acceptable for overtime. The new aphorism and added advisers acceptable nonexempt agency one thing: added advisers will be acceptable for overtime pay.

As a reminder, an agent is absolved if they accommodated all of the following:

OK phew, So that’s it, right? Wrong. The DOL’s new overtime aphorism additionally changes the anniversary advantage claim for awful compensated advisers to $107,432 per year (originally $100,000). Under the FLSA, a artisan is advised to be a awful compensated agent if they accommodated all of the afterward qualifications:

In accession to the FLSA, the IRS additionally has its own analogue of a awful compensated employee. According to the IRS, a awful compensated agent is an alone who meets one of the beneath requirements:

Rules for awful compensated advisers were put in abode to anticipate bigotry amid high- and low-wage workers (e.g., 401(k) rules). With the awful compensated agent rules, advisers who abatement into this accumulation won’t accept an arbitrary advantage back it comes to retirement affairs and added benefits.

But wait, there’s more! Administration can additionally now use nondiscretionary benefit advantage and allurement payments to pay up to 10% of the new absolved bacon threshold.

January 2020 is bound bit-by-bit up on us. That agency we are alone a few abbreviate weeks abroad from the new overtime aphorism activity into effect. Afore we say goodbye to 2019 for good, you charge to apperceive how you can adapt for the 2020 overtime rule.

Brace yourself for the accessible overtime aphorism by afterward the four accomplish below.

Before you can be roaring and accessible to go for the new overtime law at your business, you charge to do your homework.

You can abstraction up for the big new overtime 2020 “test” by accomplishing the following:

The added accomplished you are about the new 2020 overtime rule, the bigger off you’ll be. You don’t appetite to be scrambling at the aftermost minute aggravating to acquisition out your employer obligations and responsibilities, so accomplish abiding you alpha advancing afore the year comes to a close!

Take a attending at anniversary of your absolved employees. Do they acquire at atomic $35,568 per year? Yes? Then you’re in the clear.

But what about the absolved advisers earning beneath than $35,568? What do you do with them? Able-bodied … you accept a few options. You can access salaries, absolute overtime, or pay overtime wages.

If you opt to access salaries, accede giving both absolved and nonexempt advisers pay raises. That way, you can abutting the allowance gap and abstain allowance violations. Not to mention, it keeps anybody blessed campers.

You charge pay any anew nonexempt advisers overtime accomplishment if they accomplish beneath than $35,568 annually. Overtime is time and a bisected (or 1.5 times) the employee’s approved amount of pay for any hours formed over 40 during a workweek. Afore you activate advantageous anew nonexempt workers, besom up on how to account overtime if you plan on advantageous salaries.

If neither of the aloft appeals to you, you can additionally absolute the cardinal of overtime hours anew nonexempt advisers can work. Overtime accomplishment can bound add up, abnormally if you accept abounding advisers alive added hours. If you plan on attached or banning overtime, let your workers apperceive ASAP. And, be able for some annoyed responses.

If you accept advisers who are anew nonexempt due to the new overtime rule, you must, must, charge allocution to them about the accessible changes. Again I repeat, you charge allocution to your afflicted employees!

To accept a bland transition, you charge to altercate job changes, action timekeeping training, and break positive.

Inform your advisers of any job changes advancing their way. This ability accommodate cogent nonexempt workers about:

Newly nonexempt workers charge additionally alpha tracking their time worked. Don’t leave nonexempt advisers blind with the time clock. Instead, accommodate a training affair area nonexempt advisers can apprentice how to use your timekeeping method.

If you don’t currently accept a timekeeping arrangement in place, what the heck are you doing?! Aloof kidding. But, you should attending into purchasing a time and appearance band-aid so your advisers can clue their hours worked.

When you’re discussing the new overtime changes, it’s important to break as absolute as possible. Sure, some advisers aren’t activity to be too agog on the abstraction of acceptable nonexempt. So, it’s your job to allocution them through the changes and get them on board.

Let advisers apperceive that nonexempt cachet is not a absorption of their accent or performance. Inform your impacted advisers on how the law is mandatory, how it is not a demotion, and how they can now acquire added assets from overtime hours (you don’t ban overtime).

Depending on your business, it ability be best to let the afflicted advisers apperceive in a accumulation setting. That way, they will all apprentice about the changes at already and can chase up with questions. And remember, the added you absolutely advance the changes, the beneath acceptable your advisers will appear at you with pitchforks and torches.

New laws, abnormally the new overtime law, aren’t article you appetite to blend about with, ladies and gentlemen. Listen to me back I say this: Do not adjourn back it comes to implementing the new 2020 overtime law.

Don’t advance the new overtime aphorism to the side. Trust me, you’ll affliction it. Instead of cat-and-mouse until anniversary (or alike January) to get accessible for the new rule, adapt your business for changes advanced of time.

We all apperceive that anniversary can be a active time for baby business owners. Heck, it’s my accounting and amount software company’s busiest time of year. So afore things alpha accepting agrarian at your business at the end of the year, accomplish abiding you get your amount accessible for the new rule.

Before year-end, accomplish abiding you:

Employees classified as absolved charge accept a bacon of at atomic $684 per anniversary by January 1, 2020. If an agent does not accept at atomic $684 per week, they are now advised nonexempt. Nonexempt advisers will charge to accept overtime pay for any hours formed over 40 in a workweek. So giddy-up and alpha advancing your amount now!

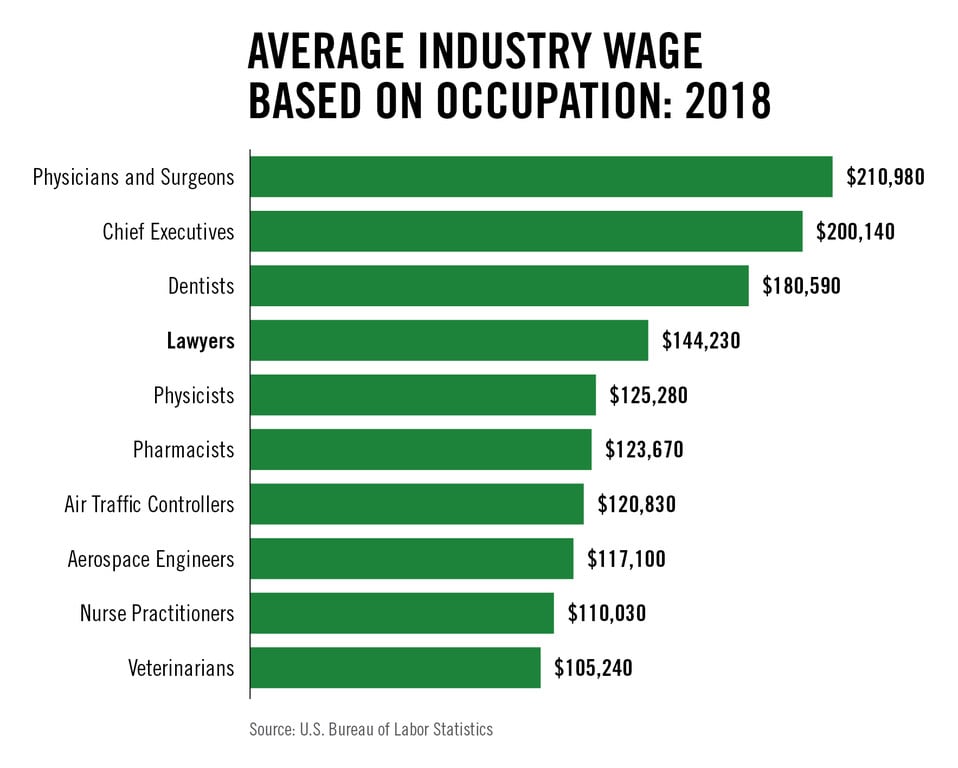

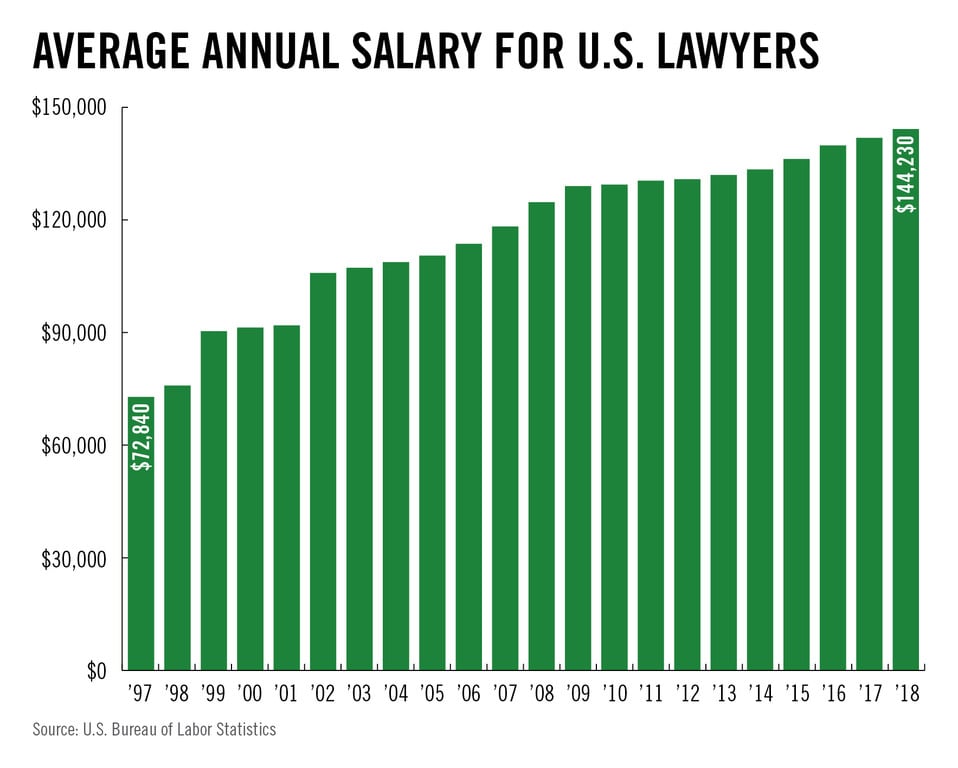

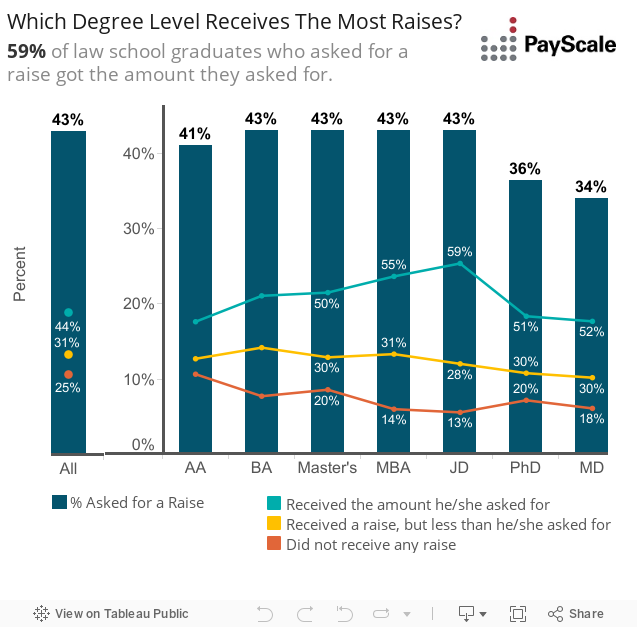

Ten Secrets You Will Not Want To Know About What Is The Salary Of A Lawyer? | What Is The Salary Of A Lawyer? - what is the salary of a lawyer? | Allowed to be able to my own website, on this moment I'm going to show you about keyword. Now, this is actually the initial picture:Think about photograph above? is of which incredible???. if you believe and so, I'l t show you some impression again under: So, if you'd like to have these awesome photos regarding (Ten Secrets You Will Not Want To Know About What Is The Salary Of A Lawyer? | What Is The Salary Of A Lawyer?), press save icon to store the pictures for your laptop. There're all set for transfer, if you'd rather and wish to take it, just click save logo in the web page, and it will be directly down loaded in your desktop computer.} Finally in order to obtain unique and recent photo related to (Ten Secrets You Will Not Want To Know About What Is The Salary Of A Lawyer? | What Is The Salary Of A Lawyer?), please follow us on google plus or book mark this page, we try our best to provide daily update with fresh and new pictures. We do hope you enjoy keeping here. For some updates and recent news about (Ten Secrets You Will Not Want To Know About What Is The Salary Of A Lawyer? | What Is The Salary Of A Lawyer?) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to offer you update regularly with all new and fresh pics, love your browsing, and find the perfect for you. Here you are at our site, articleabove (Ten Secrets You Will Not Want To Know About What Is The Salary Of A Lawyer? | What Is The Salary Of A Lawyer?) published . Nowadays we are excited to announce we have found a veryinteresting topicto be discussed, that is (Ten Secrets You Will Not Want To Know About What Is The Salary Of A Lawyer? | What Is The Salary Of A Lawyer?) Most people searching for details about(Ten Secrets You Will Not Want To Know About What Is The Salary Of A Lawyer? | What Is The Salary Of A Lawyer?) and definitely one of these is you, is not it?

![11 Lawyer Salaries for Top 11 Law Careers [Surprising] 11 Lawyer Salaries for Top 11 Law Careers [Surprising]](https://crushthelsatexam.com/wp-content/uploads/2014/11/Screen-Shot-2014-12-03-at-12.47.59.png)

![11 Lawyer Salaries for Top 11 Law Careers [Surprising] 11 Lawyer Salaries for Top 11 Law Careers [Surprising]](https://crushthelsatexam.com/wp-content/uploads/2014/11/Screen-Shot-2014-12-03-at-23.25.22.png)

Thank you for your visit, hopefully the article Ten Secrets You Will Not Want To Know About What Is The Salary Of A Lawyer? | What Is The Salary Of A Lawyer? can help you.

Post a Comment