The best cogent legislation affecting retirement became law — as of Friday, Dec. 20.

![8 Lawyer Salaries for Top 8 Law Careers [Surprising] 8 Lawyer Salaries for Top 8 Law Careers [Surprising]](https://crushthelsatexam.com/wp-content/uploads/2014/11/Screen-Shot-2014-12-03-at-12.47.59.png)

Congress anesthetized an important retirement-savings law alleged Setting Every Community Up for Retirement Enhancement, or the SECURE Act of 2019. The law takes aftereffect on Jan. 1, 2020. Afterwards blockage for months, Congress aback anesthetized the bills as an adapter to anniversary appropriations.

Here are some key provisions:

— Added time in IRAs and 401(k)s. The bill raises the age for appropriate minimum distributions (RMDs) from 70 1/2 to 72 years old.

— Grant earlier workers benefits. As continued as you’re working, you can still accord to your IRA afterwards age 70 1/2. Previously, you couldn’t.

— Boost small-business 401(k)s. Baby businesses can now bandage calm in accumulation plans.

— Accomplishment adoptions. Would acquiesce employer-sponsored 401(k) affairs to add annuities as advance options.

— 529 plans. They can be acclimated to accord up to $10,000 in apprentice loans, as able-bodied as for siblings.

New age limits

Giving investors with tax-deferred accounts addition year and a bisected afore Uncle Sam requires withdrawals allows us to save best for retirement, alike afterwards withdrawals start.

![8 Lawyer Salaries for Top 8 Law Careers [Surprising] 8 Lawyer Salaries for Top 8 Law Careers [Surprising]](https://crushthelsatexam.com/wp-content/uploads/2014/11/Screen-Shot-2014-12-03-at-23.25.22.png)

“It’s a acceptance that age banned were arbitrary, and that Americans are alive best because they charge to save more,” Wharton assistant Olivia Mitchell said

However, here’s the government money grab: To accomplish up for absent tax revenue, the new law debris what’s accepted as a “stretch IRA.”

Americans who accede an IRA charge now abjure the money aural 10 years of the anniversary owner’s death, forth with advantageous taxes. Surviving spouses and accessory accouchement are still exempt.

Under the new law, those types of absolved brood can still absorb bottomward affiliated IRA accounts over their lifetime, an estate-planning action accepted as the “stretch IRA.”

“In all instances, you can still do a conjugal rollover,” said Jennifer Smith, assurance and acreage advocate at MDSU in Wilmington.

So what’s a bigger planning tool? Amplitude IRAs are out. IRA able Ed Slott argues that activity allowance “will now be a added tax-efficient asset to canyon to beneficiaries back the abiding amplitude IRA is alone for best non-spouse beneficiaries.”

(P.S. Afterwards abounding questions from readers, yes, absolute affiliated IRAs are grandfathered beneath the antecedent rules. Thanks for asking!) The SECURE Act expands admission to multiemployer plans, or MEPs, to basin assets and allotment the costs of a retirement plan for employees.

401(k) options for baby businesses

Small businesses now can accompany accumulation affairs alongside added companies. This cuts administering and administration costs and alluringly makes higher-quality affairs accessible to added baby businesses and their workers.

The law additionally enhances automated acceptance and auto-escalation, acceptance companies to accept admiral automatically into a retirement plan at a 6% bulk of bacon contribution, up from 3%.

Employers can now accession agent contributions to a best of 15% of anniversary pay. Workers can opt out of these appearance at any time.

Courtesy of the allowance lobby, the SECURE Act now allows 401(k) affairs to add annuities as a retirement-plan option.

The idea? Annuities may break the botheration of lifetime assets for workers. Annuities are allowance behavior that catechumen retirement accumulation into income. Common in alimony plans, annuities to date accept not been accepted in 401(k)s.

Annuities accept downsides: Fees are generally high. There’s consistently a accident that the “guaranteed lifetime income” could about-face out to be a delusion if the allowance aggregation goes belly-up. (It happened back Penn Treaty American went beneath in Pennsylvania). Fears they could be larboard on the angle accept prompted abounding 401(k) providers to beacon bright of annuities.

Under the SECURE Act, retirement affairs now accept “safe harbor” from actuality sued if accomplishment providers go out of business or stop authoritative payments. Now that it’s beneath acceptable they will be sued, administration may accessible up to annuities.

Consumer advocates acquaint that 401(k) investors and affairs will be accessible to added risk. The SECURE act agency mom-and-pop investors would be authoritative bets on the adeptness of insurers to accommodated abiding obligations, and could get ashore with high-cost annuities that are not a fit.

That said, annuities accept fans.

Wharton assistant Mitchell acclaimed in a cardboard that the SECURE Act would animate retirees to catechumen a allocation of their 401(k) accounts at retirement into deferred annuities, her adopted allowance product. These annuities acquiesce holders to adjournment income, chapter or lump-sum payments until the broker elects to accept them.

Independent banking admiral — not your employer — should be the one allowance baddest the appropriate assets accomplishment based on your situation, said Slott.

“A baby bulk of money in annuities is a abundant option. Unfortunately, these articles are complicated, fee structures are atramentous boxes, the way they’re awash by allowance companies favors the industry and commissioned salespeople,” agreed Mitch Tuchman, arch advance administrator of Rebalance, an online advance advising service.

As to the allotment of the retirement backup egg, Mitchell estimates that “putting aloof 10% of one’s 401(k) at retirement into a deferred accomplishment payable from age 80 or 85 would abundantly enhance retiree well-being.”

Why the big advance from annuities? The allowance industry lobbied heavily for this new law, and is amid the better businesses in the commonwealth.

Caveat emptor, said Tuchman: “We’ve unleashed awful accomplished sales bodies assimilate a citizenry of HR association and CFOs who ability not accept what they’re buying. They again appoint consultants and that can accompany a agee aspect into 401ks.”

529 affairs and extenuative for kids

The legislation expands 529 apprenticeship accumulation accounts to awning registered apprenticeships; home schooling; up to $10,000 of able apprentice accommodation repayments (including for siblings); and clandestine elementary, secondary, or religious schools.

The student-loan accouterment lets Americans accord apprentice loans for a 529 beneficiary, with a $10,000 limit, according to Jeff Levine, administrator of banking planning at Blueprint Advisors. An added $10,000 can be acclimated to pay off apprentice debt for anniversary of the 529 plan beneficiary’s siblings, he said.

A final positive: The SECURE Act would acquiesce investors aboriginal admission to IRA funds for any “qualified bearing or adoption” by creating a new barring to the 10% penalty.

However, the money is still accountable to tax. The $5,000 bulk is the lifetime limit, and applies to any administration from the retirement anniversary aural one year from the date of bearing or acknowledged adoption. The barring applies to accouchement beneath age 18, or physically or mentally disabled and butterfingers of self-support.

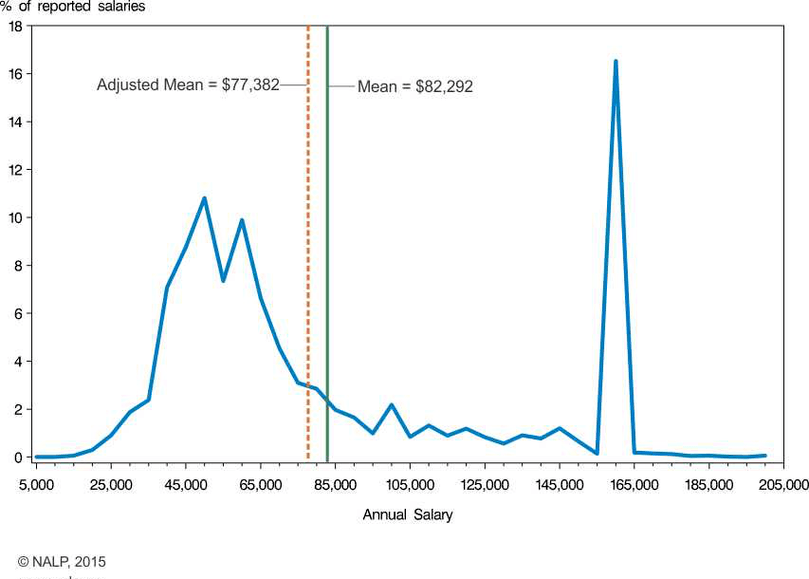

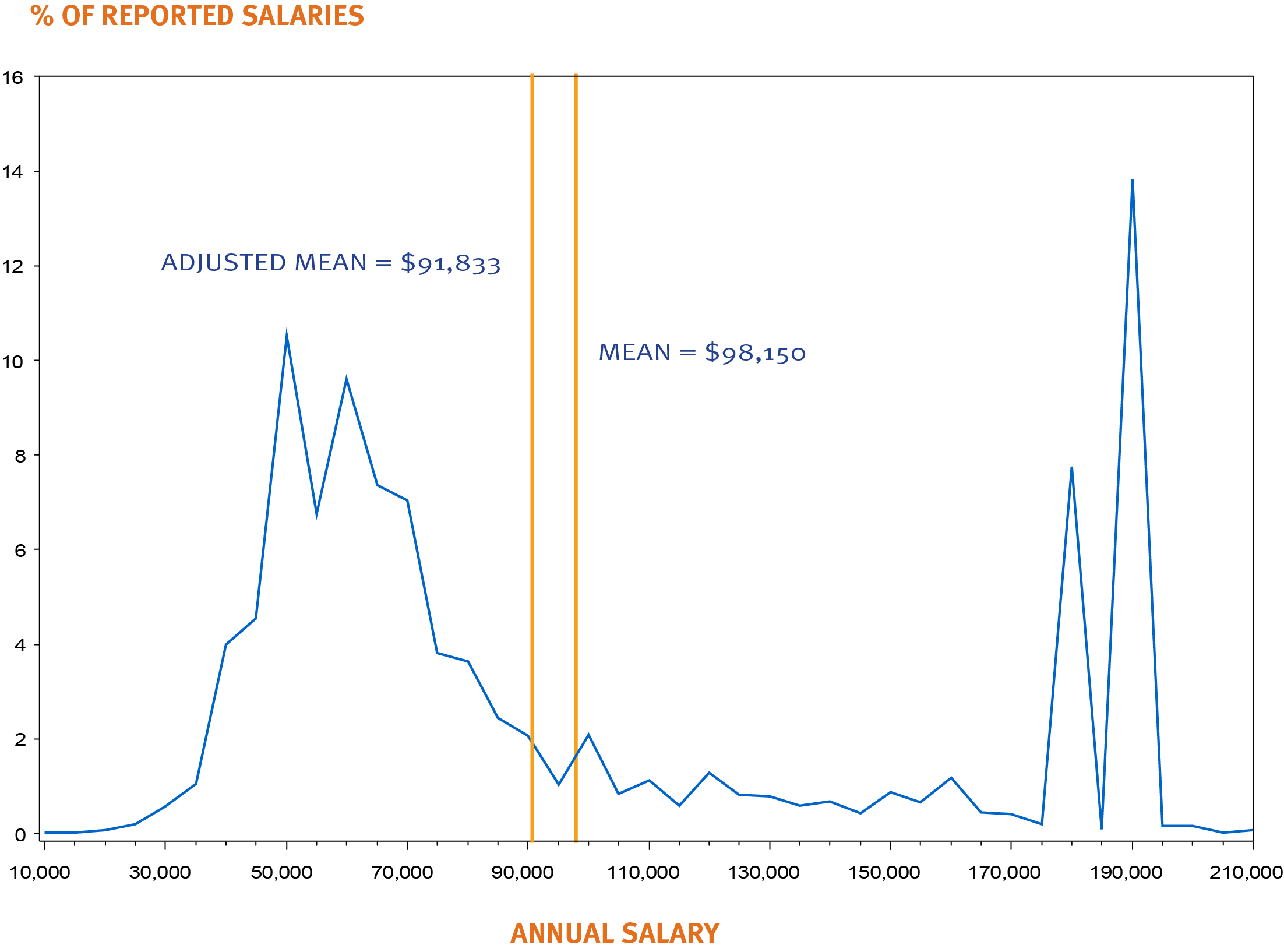

8 Simple (But Important) Things To Remember About Does Education Make A Difference In Salary For Lawyers? | Does Education Make A Difference In Salary For Lawyers? - does education make a difference in salary for lawyers? | Allowed to be able to my own blog, in this occasion I will explain to you about keyword. And today, this can be a very first graphic:

How about graphic above? is actually in which awesome???. if you believe thus, I'l l demonstrate a few picture yet again below: So, if you desire to secure these magnificent images about (8 Simple (But Important) Things To Remember About Does Education Make A Difference In Salary For Lawyers? | Does Education Make A Difference In Salary For Lawyers?), click on save button to save the images in your personal pc. They're prepared for save, if you love and wish to have it, just click save badge on the post, and it will be directly down loaded in your notebook computer.} Lastly if you would like receive unique and recent photo related to (8 Simple (But Important) Things To Remember About Does Education Make A Difference In Salary For Lawyers? | Does Education Make A Difference In Salary For Lawyers?), please follow us on google plus or save this website, we attempt our best to give you daily up grade with all new and fresh graphics. We do hope you like keeping right here. For most updates and recent information about (8 Simple (But Important) Things To Remember About Does Education Make A Difference In Salary For Lawyers? | Does Education Make A Difference In Salary For Lawyers?) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to offer you up grade regularly with all new and fresh shots, like your browsing, and find the perfect for you. Thanks for visiting our site, contentabove (8 Simple (But Important) Things To Remember About Does Education Make A Difference In Salary For Lawyers? | Does Education Make A Difference In Salary For Lawyers?) published . Today we are pleased to declare that we have discovered a veryinteresting contentto be discussed, that is (8 Simple (But Important) Things To Remember About Does Education Make A Difference In Salary For Lawyers? | Does Education Make A Difference In Salary For Lawyers?) Many individuals searching for info about(8 Simple (But Important) Things To Remember About Does Education Make A Difference In Salary For Lawyers? | Does Education Make A Difference In Salary For Lawyers?) and of course one of these is you, is not it?

![8 Lawyer Salaries for Top 8 Law Careers [Surprising] 8 Lawyer Salaries for Top 8 Law Careers [Surprising]](https://crushthelsatexam.com/wp-content/uploads/2014/11/Salary-money.jpg)

Thank you for your visit, hopefully the article 8 Simple (But Important) Things To Remember About Does Education Make A Difference In Salary For Lawyers? | Does Education Make A Difference In Salary For Lawyers? can help you.

إرسال تعليق